XRP Price Prediction: Path to $4 Amid Strengthening Technical and Fundamental Factors

#XRP

- Technical indicators show XRP trading above key moving average with Bollinger Band consolidation suggesting potential breakout

- Positive regulatory developments including SEC resolution and potential ETF approval creating strong fundamental support

- Institutional adoption and government digital reserve discussions providing additional momentum for price appreciation

XRP Price Prediction

XRP Technical Analysis: Bullish Signals Emerging Above Key Moving Average

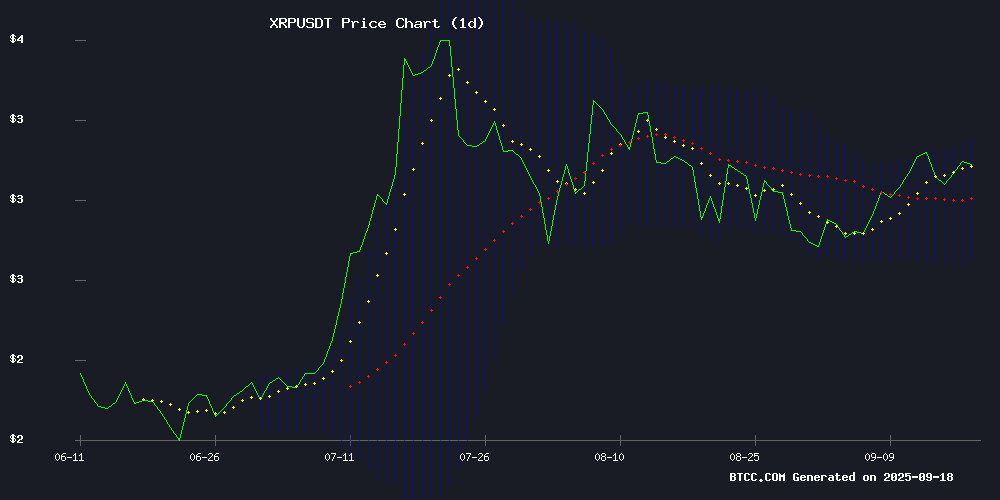

XRP is currently trading at $3.1101, positioned above its 20-day moving average of $2.9388, indicating underlying strength. The MACD reading of -0.1200 | -0.0403 | -0.0796 shows bearish momentum but with signs of potential reversal as the histogram narrows. The price sits comfortably within the Bollinger Bands range of $2.6980 to $3.1797, suggesting consolidation NEAR the upper band. According to BTCC financial analyst Sophia, 'The current technical setup favors a bullish outlook with the price holding above key support levels. A break above the upper Bollinger Band at $3.1797 could trigger further upward momentum.'

Market Sentiment Turns Bullish on Regulatory Clarity and Institutional Adoption

Recent developments have significantly improved XRP's market sentiment. The resolution of the SEC legal battle, potential ETF launch, and inclusion discussions for U.S. government digital reserves are creating strong fundamental support. BTCC financial analyst Sophia notes, 'The combination of regulatory clarity, institutional interest, and technical strength creates a favorable environment for XRP. The alignment of UK and US crypto regulations focused on stablecoins further enhances XRP's position as a bridge asset.' Market enthusiasm is growing as investors seek stability amid broader financial turbulence warnings.

Factors Influencing XRP's Price

Smart XRP Investors Turn to Mining Solutions Amid Market Volatility

XRP's price volatility and regulatory uncertainty have prompted savvy investors to seek alternative wealth-generation strategies. Rather than relying on traditional buy-and-hold approaches, the XRP community's elite are increasingly adopting OurCryptoMiner's cloud-based mining solution, which promises daily returns up to $8,600.

The UK-based platform, operational since 2019, emphasizes security and accessibility through its mobile-compatible mining system. While XRP remains the focal asset, the broader cryptocurrency market continues to react to macroeconomic factors including Federal Reserve policies and SEC decisions.

XRP Predates Ripple: SMQKE Legal Review Clarifies Distinct Histories

New research from the SMU Science and Technology Law Review, highlighted by crypto analyst SMQKE, confirms XRP's creation preceded Ripple's founding. The digital asset operates on open-source technology with decentralized governance, while Ripple functions as a centralized fintech firm building payment solutions.

The distinction carries regulatory implications. XRP's independence from Ripple challenges common misconceptions about their relationship. As a bridge currency, XRP facilitates cross-border transactions without corporate oversight—a feature that continues to shape its legal classification.

XRP Holders Urged to Prepare for Financial Turbulence Amid Recession Warnings

Bullrunners, a crypto-focused outlet, has issued a stark warning to XRP investors: the next 90 days could determine their financial resilience. Market analysts point to growing recession risks, with economic contraction projected by late 2025—contrasting official US growth forecasts. The alert comes as Ripple strengthens its cross-border payment infrastructure, positioning XRP as a potential lifeline during liquidity crises.

Spot ETF applications for XRP loom on the horizon, potentially unlocking institutional demand. Meanwhile, the Federal Reserve's anticipated rate cuts signal broader market instability. 'Government optimism doesn't reflect the underlying data,' Bullrunners noted, urging holders to adopt defensive strategies. The warning follows Ripple's continued progress in modernizing global payments—a development that could amplify XRP's role during financial upheaval.

Fed Rate Cuts Near Stock Market Highs Have Delivered a 100% Win Rate

Investors weighing the Federal Reserve’s expected rate cut this week may find comfort in a striking historical pattern. Every single time the Fed has cut interest rates with U.S. equities trading near record highs, the S&P 500 has ended the following year in positive territory.

Data from Carson Investment Research shows that in 20 out of 20 instances since 1983, the S&P 500 was higher 12 months after a Fed cut that occurred within 2% of an all-time high. On average, returns stood at nearly 14% over the following year, with some cycles delivering gains above 20%.

While the next month following such cuts produced more mixed results, with only half the periods showing gains, the medium- to long-term trend has been consistently bullish. Over six months, the index was higher about 73% of the time, while the full-year performance delivered a perfect win rate.

Markets are currently trading just shy of their peaks, putting today’s environment in line with prior bullish setups. With the Fed poised to lower rates again, analysts argue that equities could be entering another period where liquidity tailwinds outweigh short-term risks.

XRP Gains Momentum Post-SEC Win as Investors Seek Stability with IOTA Miner

XRP surged back into the spotlight following Ripple's pivotal legal victory against the SEC, triggering a 15 million XRP transfer that analysts interpret as strategic repositioning—possibly for liquidity management or institutional bets. The market's reaction underscores crypto's sensitivity to regulatory clarity.

Amid the volatility, retail investors are pivoting toward steady yield opportunities. IOTA Miner, a UK-based cloud mining platform operational since 2018, is attracting attention for its fixed daily returns and renewable energy-powered operations. The platform eliminates hardware barriers and promises withdrawal flexibility during downturns—a hedge against crypto's notorious swings.

XRP Emerges Stronger After SEC Legal Battle

XRP faced near-collapse in December 2020 when the SEC sued Ripple Labs for $1.3 billion in unregistered securities sales. The token plunged 60% as exchanges delisted it and critics declared its demise. Yet against all odds, the "XRP Army" of retail investors mobilized—submitting affidavits, tracking court filings, and transforming regulatory scrutiny into a rallying cry.

Attorney John Deaton organized 75,000 token holders to participate in the case, while Ripple CEO Brad Garlinghouse framed the battle as a watershed moment for crypto regulation. What began as an existential threat ultimately strengthened XRP's community cohesion and market position.

XRP ETF Launch Sparks Market Enthusiasm Amid IOTA Miner's Alternative Offering

The United States is set to witness a landmark event in the cryptocurrency space with the official listing of the first XRP ETFs during the week of September 15th-21st. This development is expected to fuel significant market excitement, drawing attention to XRP as investors weigh short-term gains against potential volatility.

While ETF-driven speculation dominates headlines, IOTA Miner emerges as a counterpoint with its cloud mining contracts tied to XRP. The platform promises stable returns up to $11,777 daily through deep ecosystem integration and risk-hedged passive income mechanisms—a proposition gaining traction among investors wary of market fluctuations.

Analyst Foresees XRP Rally to $36, Citing Historical Patterns

Dark Defender, a prominent cryptocurrency analyst, has projected a dramatic surge for XRP, targeting $36 in what he terms the 'Phoenix Flight.' The prediction follows XRP's resilience after dipping to $2.70 in early September and rebounding to $3.00.

The analyst identifies a long-term cup-and-handle pattern in XRP's price action dating back to 2013. Historical breakouts occurred in 2017 after a 4-year consolidation and are anticipated again in 2025 following an 8-year accumulation phase. A recent retest of the $2 support level has reinforced bullish sentiment.

Other market observers echo this optimism. Stedas and CryptoInsightUK have similarly forecast significant gains for the digital asset. Market participants are watching closely as XRP appears poised for a potential parabolic move.

Ripple CEO Announces XRP’s Inclusion in U.S. Government Digital Reserve

Ripple CEO Brad Garlinghouse confirmed XRP's inclusion in the U.S. government’s strategic digital asset stockpile, marking a pivotal moment for the cryptocurrency. The move signals growing institutional trust in XRP’s stability and utility within global financial systems.

Over ten firms, including Bitwise, are vying for SEC approval to launch an XRP ETF. Garlinghouse projects such a fund could debut by late 2025, further cementing digital assets' mainstream adoption.

This development reflects broader recognition of cryptocurrencies as legitimate reserve assets. The U.S. government’s diversification into digital currencies underscores a strategic shift toward blockchain-based financial infrastructure.

UK and US Set to Align Crypto Regulations Focused on Stablecoins

The UK and US are moving toward synchronized regulatory frameworks for digital assets, with stablecoins taking center stage. Chancellor Rachel Reeves and Treasury Secretary Scott Bessent spearheaded discussions in London, attended by industry heavyweights including Coinbase, Circle, and Ripple alongside traditional finance players like Citi and Barclays.

Regulatory alignment is viewed as a strategic lever for the UK to enhance market access and attract US capital. The proposed joint digital securities sandbox signals both nations' intent to foster blockchain innovation while addressing systemic risks posed by stablecoins—a sector gaining disproportionate regulatory attention.

Market participants warn of competitive erosion should the UK delay decisive action. The collaboration underscores growing institutional recognition of crypto's role in capital markets, though operational details remain undefined.

XRP Price Setup Strengthens as RSI Curvature Signals Potential Parabolic Move

XRP traders are monitoring a technical pattern that has historically preceded explosive rallies. Analyst EGRAG CRYPTO notes the relative strength index (RSI) on XRP’s chart is steepening—a move that has previously signaled parabolic upside in late-cycle phases.

The pattern has played out twice before, each time followed by a sharp surge. When XRP’s RSI curve steepens during late-cycle pushes, momentum tends to accelerate rapidly, catching bears off guard. EGRAG highlights the RSI structure has "held true 2 out of 2 times," raising speculation about a repeat.

Market sentiment leans bullish as the RSI alignment with broader chart structures fuels expectations of another major rally. EGRAG anticipates XRP’s RSI could "go parabolic," potentially leaving short sellers exposed. Traders grow increasingly convinced XRP may soon enter a stronger upward leg.

Will XRP Price Hit 4?

Based on current technical indicators and market developments, XRP has a strong potential to reach $4 in the near term. The price at $3.1101 is already above the 20-day moving average, and the narrowing MACD suggests weakening bearish momentum. Fundamental factors including regulatory clarity, potential ETF approval, and institutional adoption provide strong tailwinds.

| Key Levels | Price | Significance |

|---|---|---|

| Current Price | $3.1101 | Above 20-day MA support |

| Upper Bollinger Band | $3.1797 | Immediate resistance |

| Target Level | $4.0000 | 21.6% upside from current |

| 20-day MA Support | $2.9388 | Key support level |

BTCC financial analyst Sophia emphasizes that 'The combination of technical breakout potential and fundamental catalysts makes $4 a realistic target, though market volatility should be considered.'